As your state nonprofit association, we are here to provide resources to strengthen your organization.

You are taking an important step for the financial health of your organization. As a nonprofit leader you are juggling many issues and concerns. We all know that a stressed organization operating with the best of intentions can still make ill-advised decisions, especially in the financial arena – and the results can be damaging. We also know that sometimes seeing a financial crisis is difficult. We want to make it easier so you can recover faster. And we want you to see the challenges before you end up in crisis.

The purpose of this tool:

How to use this tool:

Important tips:

What next?

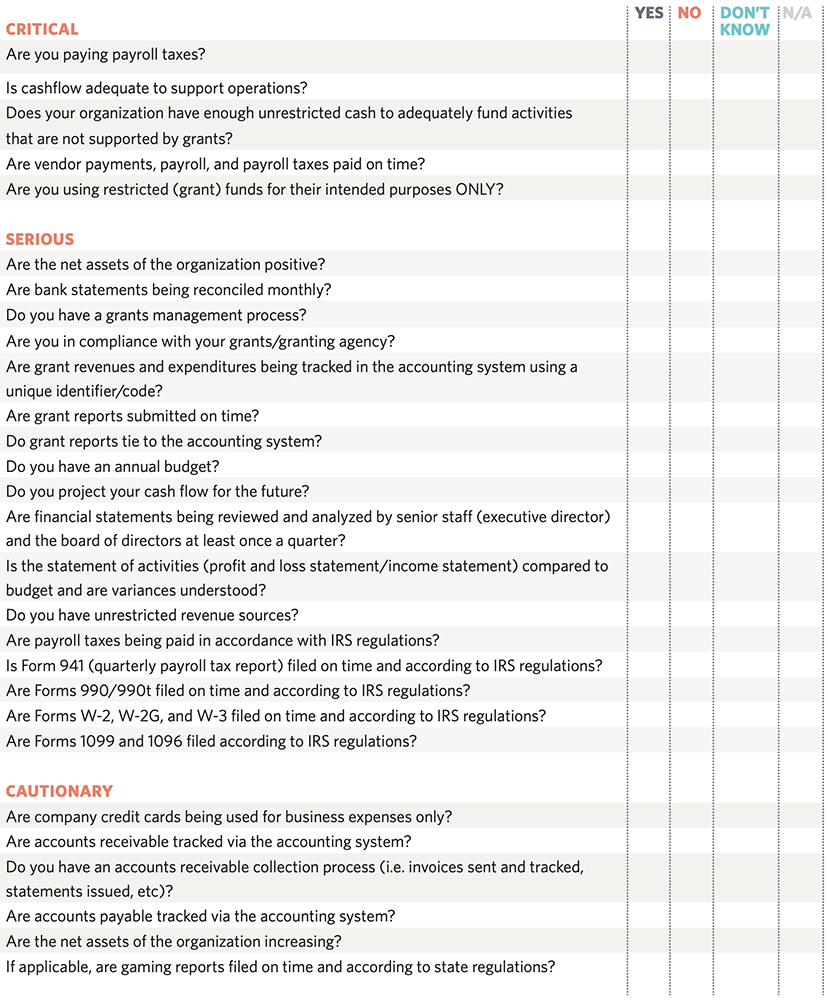

Indicators of FinancIal Crisis Organizational Self Assessment

If you answer “no” to any of these questions, it’s an indicator that financial problems could be on the horizon. If you have negative answers in the first two categories, your organization already has issues that need attention.

Now that you have completed this financial assessment, you may be asking yourself one or many of these questions: “What happens now?” “What is my next step?” “How do I get back on a solid financial footing?” The Foraker team is ready to help. In addition to calling us, below are some suggested next steps:

CRITICAL: If you answered any of the critical questions negatively, now is the time for action. Your organization is in distress. It’s time to build awareness of your fiscal situation and make a plan for stability. We encourage you to take at least one of these steps:

SERIOUS: Depending on where your organization is in its life cycle, you may still be building the infrastructure to support these items. The questions in this section point toward best practices in our field and when they are not addressed, it can lead to critical situations.

If you’ve answered three or more of the questions in the serious category negatively, now is the time to focus on reviewing and improving your financial practices.

CAUTIONARY: These are items that every organization should routinely monitor. Negative responses likely don’t equate to financial crisis. However, the responses should be fully understood. We encourage you to get a plan that focuses on the items eliciting negative responses.

If you answer “don’t know” to more than a few questions, that is an indicator by itself. We encourage you to find the answer, and then act accordingly.

If you’re feeling unsure about how to get started, call us at 907-743-1200. We have experienced staff that can review the assessment with you in a confidential, non-judgmental environment. And we can recommend steps to get your mission back on a solid financial footing.